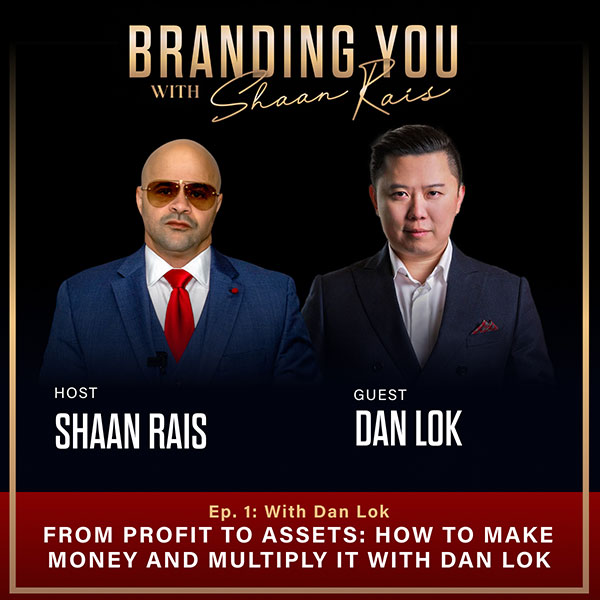

Today’s guest is Dan Lok, a globally respected entrepreneur mentor and one of the world’s most watched, followed, and quoted social media influencers with over 9 million followers across his brands. Dan shares his origin story and teaches us how to convert profit into assets. He also gives his take on leadership, investing, mentorship, and the role a spouse plays in a person’s success.

Are you ready for unstoppable wealth growth? Tune in!

Listen to the podcast here

From Profit To Assets: How To Make Money And Multiply It With Dan Lok

This is the show for you if you’re trying to grow your brand, build your brand, become the most phenomenal person that you possibly can, and personally know that in order to brand you, you are a leader. You’re pronouncing yourself as a leader to the world and you’re laying it bare. You’re becoming vulnerable and you’re using your personal brand to transform lives. It is such an honor for me to have one of my mentors. We call him Sifu. You are in for a treat, in for a delight, and it is my honor, privilege, duty, as well as pleasure to bring to you my Sifu, Dan Lok. Thank you, Shaan. The pleasure is mine. I’m happy to maybe share some of my hot-learned lessons with your audience and some of the mistakes that I’ve made. Thank you for having me. First, I wanted to say thank you. We came from a Dragon meeting, which was phenomenal. You taught for about five hours, which is a small amount of time for you. Before we even get into who you are and what you do, I want to talk about your endurance for a moment. There have been meetings that I’ve had to duck out of because they may start at 7:00 or 6:00, and they go on until 3:00 or 4:00 in the morning straight, and you’re standing the entire time. For the entrepreneurs who are reading, before we even get into the story and where you came from, how do you do that? I’m not the only one. Most people who come into a course or training of yours probably tap out around the fifth round. How does that work? First of all, I am fortunate that I found my passion. Some people say, “You’ve got to do what you love.” Sometimes people say, “I love this so much. It’s the only thing that I would do for money.” The first coaching that I want to share with the audience is I believe instead of, “I love this so much. I’ll do it for free,” it’s, “I love this so much. It’s the only thing that I would do for money.” To be able to combine our passion, purpose, and profit, you can build a profitable business around your purpose and passion. I’m grateful that I can do this. I’ve been teaching now for many years, being on stage, speaking, and on social media. I’m grateful I can do this. I love doing it.People ask me the question, “Why do you love teaching so much?” I don’t golf. I don’t fish. I don’t have many other hobbies. I love businesses. I love to teach. People love golfing. They can golf for 3, 4, or 5 hours, which is not an issue. People love fishing. They can fish for 4, 5, or 6 hours. It’s not an issue. I love to teach. When I teach, I’m in a zone and time disappears for me. That’s why I could do it. Afterward, my back aches a little bit or my shoulders are a little stiff because I’ve been standing for so long. When I’m in the zone, I forget. Time disappears for me.

That is the highest place for performance.

If someone was to ask you the question, “If you have ten times more money, would you still do what you do?” if you would ask me that question, I will look you in the eyes and say, “Absolutely.” I do have ten times more money compared to what I had before, and I’m still doing what I do. I’m doing it because like I doing it. I’ve got all the other businesses and all the other ventures. I always want to dedicate a part of my time to teaching. This is what I like to do. Someday if I don’t feel I want to teach, I don’t teach. So far, I still very much enjoy doing it. I enjoy seeing you as my mentee and my other mentees seeing their growth. It’s awesome to see. I get a lot of joy from that.

For everyone, this is one of those pin moments, passion, purpose, and profit. Your brand exists at the intersection. Your best and most phenomenal life exists at the intersection of those, your passion, your purpose, and your ability to make a profit. As he said, you’re in a zone and time disappears.

If you have passion without purpose, you’d be doing it. You still will feel somehow a little bit empty. You’re like, “I love this.” It’s like, “You play golf?” “Yes, I love doing that,” but it doesn’t mean that it is meaningful because you’re not impacting others. On the other hand, if you do something purposeful and meaningful, you get a lot of joy and fulfillment from it. Without profit, you won’t be able to sustain. You can help people by being a volunteer. That’s good. With profit, you can be a nonprofit organization and you can help so many more people.

If you do something that’s purposeful and meaningful, and you get a lot of joy and fulfillment from it but no profit, you won’t be able to sustain it.

I look at that as your purpose. That’s great. If you have passion, that means you could keep doing it for a long time and you’ve got a profit center. You can build around that. You can sustain for a long time and you can have more profit to do more things. I wasn’t always this. Going back to the story, let’s say 20 to 30 years old in the business, the first 10 years, I wasn’t this. I was much more money-driven. I was more ego-driven. I was more of a jerk, quite frankly.

Those are expansive. There’s a lot there to unpack. Before you go into those years, I wanted to give the people an a-ha moment to rip it open, something they can get their money’s worth from immediately. That’s what we’re both about. Before we go into the beginning of the business, what about personal life? Tell the people where you came from first and foremost and what your origin brand story is.

I was born in Hong Kong. I immigrated to Canada when I was fourteen years old as a teenager. Shortly after that, when I was sixteen years old, my mom and dad got divorced. I was living with my mom in Vancouver, Canada. My mom and I were living in a one-bedroom apartment. We were renting. My mom would sleep in the bedroom. I would sleep on the floor in the living room. I slept on the floor for many years. I was going through school a year later when I was seventeen years old.

My dad then went bankrupt because his business partner took all the money and disappeared. My dad was the guarantor on everything. He signed all the papers. That devastated him. From then on, my mom and I were on our own. My dad couldn’t send us money anymore to go to school. My mom had a tiny bit of money. I was a teenager. I made a decision and say, “I’ve got to take care of my family. I’ve got to take care of my mom.”

My mom was scared. She didn’t know how to make a living. She’s a housewife. Before then, success, money, and all these things never interest me. Out of necessity, I said, “I’m going to make some money. I got to be successful. I got to take care of my mom.” That’s how I got into the business world. I never thought of becoming a businessman. My biggest dream at the time was to open up a martial arts school and teach. That was a big thing.

Do you do martial arts then?

Yes, because I was getting beat up in school. I was getting bullied so I was learning martial arts. I was thinking to myself, “It’s changing my life because it’s giving me more confidence. It’s making me healthier and maybe someday I could teach this.” What I didn’t know was that planted a seed in my mind that maybe I like to teach but now I’m teaching. Since I’m not teaching martial arts, I’m teaching business, but I’ve always had that teacher’s heart in me at a young age.

One of the things that I picked up from where you are now and from where you started with that not being your thought initially is that your why was a who. A lot of people have what’s your why and your motivating factor and the drive, the cars, the luxury, and the things that people might know you for and might associate your brand with or you as a man. They might associate those things with you and think that you’re driven by this or that or extravagant things and a lot of money. What got you to this point is the origin brand story and the fact that your why was actually a who.

Partially, it’s also that I take responsibility. It’s also my fault because you teach branding, personal branding, and corporate branding. It’s a message that we’re putting out there. This is not what your audience would expect, but I’m being vulnerable here. When I was getting bullied in school, I was the invisible kid.

I was the kid that would sit in the back of the classroom, never put on my hand, and never ask questions. I would usually leave the class before school about ten minutes early. If I leave at the same time as everybody else, when I walk through the hallway, I get picked on. I had to leave early before all the kids come out so I can go home safely. That was what I was going through. I was living in fear every day.

In the beginning, I was driven to support my mom to guide this business. Later on, it is also ego-driven because I want people to know that I’m somebody. I want those kids to know I’m smart. I’m successful now. For the first 10 years of my business career, 20 to 30 years old, I was driven by almost revenge, almost to prove somebody wrong. All that comes from my insecurities because I’m an immigrant. English is not my first language. All those bought up emotions that I wanted to build a business. This is why the way I was doing business was not good.

Even when I went on social media years ago, I wanted to be famous. There’s a shallow reason. I want people to know that I’m smart. I want people to know that I’m successful. I also notice when I show off my wealth, I get more attention. When I show off this, show off my watch, and show them my thing, I get more attention. When I’m teaching in terms of money and sales, it’s always an emotionally-charged subject.

You’re teaching money this and that, and people will associate you with, “Are you a fraud? Are you a scammer?” When you’re teaching that stuff, people associate you that way. You can’t avoid it. That’s why I say I take responsibility because, through the process, I thought that’s what I wanted. I want more attention. I want more fame. I want to grow my business. I want to do all that stuff. Through that, I learned. I’m evolving. I see that even as a mentor, I’m evolving.

You’ve seen me a few years ago. Maybe you can share your perspective. I’m evolving as well. More and more so, I take responsibility for that because maybe people see me that way and they think I’m more materialistic. Actually, I’m not at all, especially now. Money doesn’t drive me at all. A brand is a brand. That’s what people see you. I’m still a work in progress, but now I see that I’m not driven by those things. I don’t care what people see and like. They see that you’re successful, wealthy, and all that. I noticed the content that I do in the last couple of years. I don’t do that anymore.

I’ve seen much more consistency. As a matter of fact, that’s one of the reasons why we connected. When I came, we connected and we met man-to-man or brand-to-brand in person, I could see the humanity, vulnerability, and authenticity. Those are the guiding principles of my brand and my business as well as being highly successful and in a position of leadership that gives back.

I have an upbringing in Harlem myself. I started off with a bad rap, one that was probably legally justifiable. I know what it’s like to have the first stone cast against your glass house and then have to rebuild, fortify, and solidify it, and be judged not as you are but as you’re painted or as you appear to be. I appreciated that much.

Daymond John says, “Your life is a series of mentors.” I was new to the whole mentorship. We’re used to coaching where I come from. Mentorship was a new understanding. When I researched a couple of mentors of yours, Alan Jacques and Dan Peña, you have a third mentor now that you talk about. I’d like to know a little bit about how you got into the business because some people know you for closing and they might not know you as much for the copywriting and the intense scrutiny and the scientific method of closing through print and what that science is.

In this Facebook advertising world where you purchase clients, that science is lost. It’s a science like prehistoric bones that need to be dusted off and brought back to life. If you don’t mind sharing a little bit more, maybe the first segment of your business that you were about to go into, the first ten years, where was Dan Lok and what was Dan Lok doing?

I wanted to provide for my mom. I had these crazy ideas. Maybe I could do different businesses. Nowadays, the kids would say side hustle. I was doing a lot of side hustles. I was trying to deliver packages, fix computers, and do all these things to make a living. None of them were successful. I wasn’t making good money.

In fact, I lost a whole bunch of money. I lost all my mom’s money. I lost my relative’s money. I was about $150,000 in debt when I was twenty years old-ish. To a twenty-year-old, $150,000 is a lot of money. We’re talking about many years ago. It’s a fortune. I was lost. I had the drive. I had hunger. I wanted to build something, and I wanted to be successful. I just lacked direction and some guidance.

Through luck, I met my first mentor. His name is Alan, as you mentioned. Alan took me under his wing and gave me my first high-income skill of copywriting, how to use words to influence and to sell. He took me under his wing for one year. Afterward, I started my own one-man advertising agency, one-man show, one-man band, working from home and writing copy sales letters, at the time, direct mail letters, and campaigns for business owners for different types of businesses.

Shortly after that, I was making six figures a year as a copywriter. Again, for most people, it may not be a lot of money, but I was 21 or 22. That was a lot of money for me. I was able to provide for my mom, slowly paying off the debt. That’s my first little taste of success in business. I was like, “I could utilize my skills and talents to deliver some value, make a living, and provide for my mom.”

After that, my clients who I was writing copy for were asking me, “Dan, this is great. How do I use this? How do I mail? How do I do the marketing and all that?” I’m like, “You do this and this.” They like my answers. I started charging for consulting. If I’m copywriting, suddenly, I have another side business that adds to my existing business. Think about this. I was 23 years old and I was now consulting with all these business owners who are much more successful than me, who have much more money than me, but somehow, I’m consulting with them.

That, in some way, gave me a head start in business because most people are running one business. They solve one set of problems. When I’m consulting, I’m solving business problems on the spot. You’ve seen how I work. Someone can give me a challenge and say, “Do this and this.” I could see, “This is what you need to do.” To be able to stand on my feet and do it, it’s almost like jumping off an airplane with no parachute on because I don’t know what they’re going to ask. To be able to solve complex business challenges and problems within minutes, I got exposure to all these businesses at an early age.

That’s interesting because it brings another titan of the mind. That’s specifically Jay Abraham who consequently happens to be one of Daymond John’s mentors. I’ve met Jay Abraham. He’s a phenomenal individual, a sage, and an eclectic wizard of copy and marketing. They call him the Godfather.

I’m a big fan of Jay.

He says he looked at thousands of industries and verticals within small amounts of time. Over the years, he’s compiled this ability to see in 3D. I don’t know if you’ve ever thought about this, but how many business models have you looked at?

It’s got to be hundreds. I never keep track. Think about it. I’ve been doing it since 20-somewhat years old to now I’m 40 years old. There are so many all these businesses. I don’t know how many. What I notice is most business problems, to the business owners, feel unique. It feels, “Only I got this problem and you don’t understand what I’m going through.”

When I’ve consulted with so many businesses, you notice, “I saw that last week.” What feels unique is not unique. It’s like when we get sick. When we have flu, “I got a headache.” You feel like, “You don’t know what I’m feeling.” Actually, many people feel the same way. It’s the same symptoms, and I started noticing patterns.

It doesn’t take a rocket scientist. When you’ve done this long enough, you’re like, “I see patterns of this is good and that’s not good. You do this, you make money and you do this, you lose money.” It’s almost getting paid alert. I’m consulting all these years. I transitioned from a consultant, then I went online and started my own business, selling online, getting into affiliate marketing, using my copywriting skill online, selling digital products, and selling eCom products. That’s when I made my first “bucket of gold,” my first pile of money to do everything else. Through that process, I recognize how important those skillsets are that I’m able to build my companies. I’m still using the same skills I’ve learned years ago. You think about it.

It’s the high-income skills that have been able to contribute over and over again. It’s the same skillset matriculated, but they’re preferable skills in the business industry.

Here’s what I believe. If they want to become a millionaire, $10 million, $100 million, most people would become wealthy if they focus on one skill at a time instead of Shiny Object syndrome, “Let me have a little bit of this. Let me take this course. Let me listen to this podcast. Let me do all that stuff,” but they’ve got no depth. They don’t understand what the purpose of learning is.

The purpose of learning is not information gathering. The purpose of learning is mastery. What is mastery? Mastery is the ability to execute effortlessly without the use of conscious effort. When I master one skill, over the years, I’ve simply stacked on my skill. First, I have copywriting, then I have consulting. To sell consulting, I need to develop the skill to close on the phone so the clients would pay me and hire me. I have to develop that skill.

I learned how to close on the phone and then I went online and learned about marketing into marketing, how to drive traffic, and how to convert that traffic. Now, I’ve got internet marketing as a skill. I’m stacking on these skills. Part of it utilized my copywriting skill to create those landing pages and those emails. From there, as I’m doing it, I was 26 or 27, making a lot of money. I then have other business owners asking me, “Dan, how do you do that?” We’re talking about many years ago, before Facebook and all that. People were asking me, “Dan, how do you do this?” I opened up my laptop. I said, “Do this. This is what I do.”

They’re like, “That’s too fast. Can you break it down for us?” I said, “What do you mean? Just do this.” “Break it down for us.” I said, “Okay.” Before you know it, “Can you spend a few hours teaching us?” “Okay. Fine.” Before you know it, “This is so good. Can you teach a few more people?” Before you know it, it got a little workshop going on. I’m a speaker. The crowd gets bigger and bigger. Now, I’m like, “I’m doing this.”

In the beginning, I didn’t charge anything. I’m just happy to help. Maybe I can do business. Maybe I can do speaking. Maybe I can do some sort of workshop and charge for it. Now, because I joined the Toastmasters speaking skill, I’m like, “Maybe I could use those skills but now I’m going to do it professionally and turn it into another income stream.” From internet marketing, I stack speaking on top of it. You see my journey.

I see it. The thing that I see is clients always asking for you to develop the next skill so that you can solve their problems on the ground.

Accidentally, over the years, then I’ve got all these skillsets.

Tony Robbins says recognizing patterns. You used it as well. The way he uses this pattern recognition, pattern utilization, and then pattern creation. You recognize patterns and you utilize the same pattern of habit, skill learning, repetition, and mastery of it. You are looking at knowledge the right way, the acquisition of knowledge for the right thing, not just retention or collection, but actual mastery.

You are coming back and creating your own patterns to disrupt industries and be innovative and strategic and create a whole new business model. We can go into an MBA. We can go into the qualitative all day. I want to move a little bit back to the quantitative because I recognize patterns too. This is one of the patterns that I recognize around high-level sages and gurus in this industry. It’s funny because they do this in the high office.

You can’t become a president without a wife. You can’t have a high position in religion if you’re not married. I noticed that all of the cadres of the top influencers, business owners, and people that are making a difference in people’s lives have wives. My wife saved my life literally and figuratively. She spared my life a couple of times, too.

We go to your website and we see something that you don’t see often. We see Jennie’s page and Jennie’s Story. I like to know, for the female entrepreneurs out there, for the men entrepreneurs who may not be married or who are married, what role does that play in the life of an entrepreneur yourself?

Jennie and I have been together for fourteen years now in 2022. We’ve been married for eight years. When we met, I was building but nowhere near the success I have now. From day one, it’s interesting. I have a couple of months of dating like, “This is about to get serious.” I have a conversation with her and I said, “Jennie, we’re a little more serious now. I want to let you know I have certain expectations. I’m not a typical boyfriend. We are going to be together. There are a lot of things.”

“I’m probably not a good boyfriend because I’m a workaholic. I’m driven. I’m career-oriented. There are certain expectations that you have or might have that I will not be able to meet.” I laid that out. “I would probably forget your birthday. I would probably forget our anniversary. I forget my own birthday too. This is who I am. If you have those expectations, we will not be a good fit.” I do all the negative stuff up front.

That’s an interesting statement. Go ahead.

It’s like, “I probably won’t get you flowers. All this stuff you’d expect from a guy, I don’t do any of it. I’m not romantic.” She’s like, “Okay.” “Here’s what I will do,” I said. “Let’s set some goals together. You tell me what your goals are.” We do this exercise. She wrote down an example. She said, “I would love to go to Disney.” She’d never been to Disney. “I would love to go to Japan.” She wrote all these goals that she has. I said, “I may not be able to be a typical boyfriend, but I’m going to make all these dreams come true for you. That’s my proposition.”

That was your value prop.

She said, “Okay.” In return, I said, “I love for you to support me in what I do.” She’s always been, in the beginning, supportive in terms of helping me with little things here and there. Later on, there was one incident. A number of years later, I had to do a conference, a two-day event. The event planner that I hired disappeared. I thought my money disappeared. He didn’t coordinate and organize the event. I was like, “This is going to be a disaster.” I got too much to worry about. Jennie was like, “I’ve never done this before. Maybe I could help.” She stepped in and helped to organize the event and she did a phenomenal job. I’m like, “This is way better than the event planner.”

At the time, because I was traveling a lot, she was like, “If you’re traveling this much, why don’t I go with you? We can spend more time together. Plus, I can know more about what you do.” More and more so, she got more involved in my business. Now, she’s very much involved. For everybody, for my audience, she’s not a trophy wife. She’s not just a wife or she’s Dan Lok’s wife. She’s Jennie. She’s her. She is so important to what I do in my business. She’s super smart. I say this. You will only be as successful as your spouse allows you to be.

You will only be as successful as your spouse allows you to be.

Go a little bit deeper into that.

If you are ambitious, you have certain goals. Let’s say you want to build this size of business, and your spouse is like, “Why do you work so hard? Why do you want all that? When is enough?” If you have a spouse that’s like that, you’re going to have a problem. Both of you need to be on the same page. If you want a lot of success and your spouse wants just okay or mediocre effort like everybody else, you’re going to have conflict at home. That’s a problem.

Jennie and I are always on the same page. She sacrificed a lot because, in some ways, she builds her life around what I do. Her schedule revolves around my schedule. She gives up a lot. If you ever see her life event, she’s helping out. She’s doing everything in the schedule. In the beginning, she was struggling with her identity too until we talked about it. She made a decision, “Dan’s success is my success. Let’s focus on his career. Let’s help him. His success is my success.” When it took on that, here we are. I will not be where I am now without her. It’s not even close.

Thank you so much for that. Me and Dan, we can go on and on. When I met Dan, there were a lot of things that I wasn’t doing that I do now. I had on a white shirt and a red tie. I was getting there, but I wasn’t quite there yet. I met with Dan, and a lot of things changed. One of the things that changed was this guy right here. This guy right here was inspired by that guy over there. I came on to the SMART Challenge. I saw Dan and said, “He’s got a toy icon of himself.” I said, “That’s branding on a whole another level.”

I’ve learned so much from Dan Lok, and my numbers increased. I was able to add a zero to the back of my offers. I’ve learned so much. My ZIP codes, the car, and the watches I wear have changed. The only thing that hasn’t changed is the morals, the values, and the principles. They stay the same, but they have been strengthened. When I bring a person of Dan’s caliber in front of you, I want you to understand the quality and the genuineness of the character and the individual that’s being brought before you. Dan, again, I’m honored, pleased, and humbled to have you do this for my audience. Thank you again.

Welcome.

I want to talk more about the direction now and where you’re headed. There’s so much that you’re doing, and it’s happening so fast. You’re like an alien to regular people. I’ll be honest.

I have 3 eyes and 4 legs.

We talked about how long you can stand and how long you can teach, but everything that you’ve been able to do in such a small amount of time. Most people in specific generations that talk about copywriting and direct response marketing are well into their 50s, 60s, and some, 70s. You’ve been able to do all of this in 30 years, maybe 20 years. How does that happen? Who qualifies to be a mentor to you? Let me ask you that.

I have my personal mentor, Alan, my 2nd mentor, Dan Peña, my 3rd mentor, Dwayne, and then my 4th mentor now, which is Ivan who is in venture capital and is also my business partner. I don’t want to say I’ve done a lot because compared to Elon or Jeff Bezos, I’ve done little or nothing. I look at what Elon has done, but in my little career, over the years, most people have a problem.

Even in this industry, in the influencer space, in the coaching space, in the copywriting space, or the marketing space, most people who get into it get stuck in it. That’s, “I’m a speaker.” They speak for 30 years. The same people that I was studying from many years ago fast forward to now are still doing the same thing. They’re doing the same. The speakers that I was listening to are still doing the same thing. They haven’t been able to break out of that glass ceiling in my mind.

In some way, I always look at what I do. Those are my skillsets, but it’s not necessarily who I am. That’s a big distinction. I have copywriting skills, but I’m not a copywriter. I have consulting skills, but I’m not a consultant. I have speaking skills, but I’m not a speaker. Those are skills that I have, but it doesn’t box me into a certain identity. Fast forward now, if you ask me several years ago, most people would see, “Your teacher is high ticket closing.”

Your skill sets are not necessarily who you are.

People think I’m a YouTuber, which is funny. People are like, “You’re on YouTube. You must be a YouTuber.” That’s how people think. You’re on TikTok. You must be a TikToker. That’s how they see. I see that’s just a platform in my mind. You see all these skills I have and fast forward to now, I’m looking at what I do and where I’m going with all the skills.

If you ask most people, they see probably that I teach closing and coaching and they will see that’s what I do. You are my inner circle. That’s not what I do. I’m the Cofounder of Meetn, which is a direct competitor of Zoom. That’s a SaaS company. I am a Managing Partner of DragonX Capital, which is a venture capital firm that I’m a partner in.

We invest early in C-stage tech companies. Here’s what you don’t know yet, but I also assume the CEO position for a financial service company, FV Vantage, which is a lending company. Financial service is my real business. I do the teaching things because I like doing it, but that’s not where the money is. I’m able to make a lot of money doing it. Don’t get me wrong, but I also impact a lot of people.

I’ve taken a lot of earnings. First, you got to learn how to make the money. Once you learn how to make the money, then how do you actually not spend it? You save that. How do you multiply it? I would save the next 10 or 20 years of my life, not making it, but I’m spending more of my time managing the investments and portfolio more like an investor. I am a CEO but also a CEO/investor. That’s the next 20 or 30 years of my life.

For the audience, while you’re making money right now and you’re looking to become a coach, consultant, speaker, and all that good stuff, he said, “Make the money, save the money, and then smartly invest the money so you don’t have to do it for life.” The skill that you’re using right now to get in, you don’t have to stay there. Use it to get the resources, hold on to the resources, and then apply the resources and other things.

You said, SaaS, a direct competitor with Zoom, venture capital, and then a financial services company so that it turns over on itself. Let me ask you a question because I want everybody who is a professional services provider, these coaches, these closers, and these speakers to know this. I’m going to get into leadership in a moment, but the same level of skills that you’re using here are applicable to those other principals, aren’t they?

You apply them at a higher level like raising capital. They’re still closing. You’re just selling bigger things. You’re selling to a different audience. Here’s what I believe. One of the most common things I see in the coaching, consulting, and speaking space, in which a lot of your audience is, is high-income but underinvested.

They’re speaking. They’re coaching, they’re consulting, and they’re making the money. They’re making a profit. They get a little house. They get a little thing. They go on little vacations. They do all that. What they don’t know is that’s only half the game. Imagine this, Shaan. Pick any sport, let’s say basketball or football. What if you only play half the game, and the other half, you say, “I don’t play,” are you going to win?

Not at all.

They think, “First, I need to know how to get clients, how to make offers, how to grow, and how to scale the business.” They think that now the business is making good money because of thousands of dollars, millions, or tens of millions of dollars, “I’m done.” That’s half the battle. That’s half the equation now because you look at most of them.

I see them, my peers, speakers, influencers, and anyone in that space. Through their careers, they made millions and millions of dollars, but most of them, if you say, “What assets do you have?” they will say little to none besides their home, which is not an asset anyway. You’ve made millions and millions of dollars, but at the end of life, they got nothing much to show for it. I saw that. I won’t name but there’s this certain speaker that’s legendary. If I say the name, you would know. We all know.

Go ahead. I’m loving this.

You would see them. They’re 70 somewhat years old and they still have to go get on a plane, travel somewhere, do a speaking gig, and pick up a $15,000 or $20,000 check. I said, “I don’t want that.” This is a vehicle. It’s my passion, purpose, and profit. Great, but I want to take that money. I don’t want to be income-rich and asset-poor. I want to be income-rich and asset-rich.

If I’m going to get on a plane and speak, I do it because I like to do it, not because I need that speaking gig check. I saw that. I said, “These guys have speaking skills, great. Maybe they have coaching skills, great. They have marketing skills, great. They have copywriting skills, great, but most of them don’t know how to build a business. That’s what I noticed.”

For most of them, it’s one person and then a few staff or a few assistants. That’s not a business. They’re not actual business people. Second, they don’t know how to invest. When I look at that, I don’t want to be a speaker. I’m going to learn the skills that it takes, the leadership skill, the team building skills, all the skills that I need to be a CEO of an organization and also an investor. My money works for me I don’t want to have all this income coming in and then just spend it. Where are the assets? We need to convert that profit into assets. That’s the second half of the game. In other words, we develop skills so we can generate more income. We build a business so it will generate more profits. Getting a business gives us more leverage so we can generate profits beyond our physical presence so we have more cash to invest. Until we invest and convert that into your net worth, you’ll never be wealthy.

They’ll be cash-rich, asset-poor, and have money but not be liquid.

The money’s not working. They’re still working for the money.

They don’t actually have freedom.

They will never have freedom because when they’re not coaching, speaking, or doing the thing, money stops. I’m teaching not because I don’t need the money. I teach because I like to teach. You’re coming from a different place.

There you go. Now we’re talking about authenticity.

Buy my course or don’t buy my course. It doesn’t make a difference to me.

I love it. Dan, we talked about team building. We’re going to dig deeper into that. Before we do, I want to get into this conversation about investing. There are a lot of people with a lot of conversation around investing. They talk about real estate, flipping, money, and what they can do with the cash cap. Can you shed a little bit of light on this thing?

I’ve done a lot of investing. We’re doing internet business. I always like tech and the internet.

In my late twenties, I was an angel investor. For those of you who don’t know what an angel investor is, it’s an individual investor. I would put in a little bit of money. Here’s a young founder. It seems to be a little nice website with little tech maybe. I’ll give you a little bit of money, not a lot. Maybe $30,000 $50,000, whatever. Maybe they’ll turn into something. I don’t know. I made these angel investments not knowing what I was doing. Although I know internet marketing, I didn’t know tech. I wanted to be in tech.

I invested in these companies. All ten lost money. I put all money in all 10, and all 10 lost money. It never stopped me from thinking, “There’s something here.” I do have other investments, but I am simple. I don’t do NFT. I put $0 in crypto. This is why it doesn’t affect me whatever’s going on. I have some real estate. Now, most of my money is in tech. I’ll give an example, Peter Thiel. In 2004, he invested $500,000 to buy 10% of Facebook. When Facebook went public, eight years later, that $500,000 turned into $1 billion.

It’s one single investment. Facebook, as you said, is the alien. It’s 1 in 1 million. I get that. When I see something like this, and you can talk about Uber and all these other tech companies that are in our lives, I said to myself, “That’s what I want to be in. That’s what I want to invest in because software eats the world.” That’s what I believe.

In every single thing we do in our lives, software touches our lives one way, shape, or form. Look at your cell phone. Look at our computers. Look at everything that we use. Look at the Uber that we use. Look at everything that we do. Many years ago, most of the biggest companies in the world, telecommunication and oil companies, you see that. Fast forward now, the biggest companies in the world are Amazon, Apple, Facebook, you name it.

Here’s a question, Shaan. Years later, what companies do you think will occupy to be the biggest companies in the world? Almost all of them will be in tech. I don’t need to be a rocket scientist to say, “There’s a lot of money. There’s a lot of wealth being created. How do I be a part of that?” I cannot build something. I’m not a builder. I didn’t go to Harvard, Stanford, or MIT. I’m a street-smart guy. I cannot build something, but how could it be part of it? That’s when I made a decision I wanted to invest. Now here’s the thing. I haven’t this shared with a lot of people, but I’ll share it with you.

I made a decision. I’m making a lot of money from what I do. Business, I want to put that to work. I don’t want to buy stock or any of that stuff. Here’s the thing. Anyone can go and buy Facebook stock. Let me ask you this. If you have an opportunity to go back in time to 2004 to put $500,000 into Facebook, would you do it, yes or no?

Of course.

Everybody would say, “We would do it.” I said, “It won’t happen.” Here’s why it won’t happen. One, Mark will never call you and me. He will call Peter. We will never see that deal. You will never see that deal. You will never hear about it. By the time you hear about any of these techs, Uber or Airbnb, it’s IPO. It’s ten years later.

Second is, even though Mark does call you, not the Mark now, in his dorm room with the sleepers on, looking like a geek with oily hair, are you going to invest in that guy and give him $500,000? Chances are the answer is no, seriously. Those opportunities never get to people like you and me. When I went into the industry, I was like, “I’ve got this money.” It’s almost like you go to play in the casino, “Can I play?” They’re saying to me, “You can’t play.”

I felt that way myself. I understand it completely. Most of the people reading this have felt that.

It’s a club. Think about it. They say, “You are not one of us.” I have money to invest. Money to them doesn’t mean anything because they have money too. Go to Google. You look at the biggest tech companies in the world and all the names that you will know, it’s all invested by a small group of companies. It’s all the same group of people. It’s a monopoly. They said, “You’re not Harvard. You’re not Stanford. You’re not MIT. I’m sorry, you’re not White.”

Here we go. We’re digging into it now.

I was pissed quite frankly. I was like, “Why?” “You’re not one of us.” It took me years to exhaust my network. I said, “I want a seat at the table. How can I get into the game?” I know what you know. Think about that. I know the US, in San Francisco, in Los Angeles, we know how wealthy the Chinese community is and how many properties they buy out. We know that. I’m like, “How come they’re not investing in tech?” It’s because they can’t get in. I said, “If I can get a seat at the table.”

We have the same conversation in the Black community. Go right in.

That’s exactly that. How come you don’t see African American investing in all these tech companies?

That’s why we’re having this conversation, Dan. Go right ahead.

Why? As I said, would you invest in Facebook? Yes, but they will never call you. I’m like, “How do I get in the game?” I use all my network, and I’m in YPO. Finally, I’m able to meet someone. I said, “How can I get in the game?” After all these years, finally, I met my mentor, Ivan Nikkhoo, who’s got many years of venture capital experience. He used to be the Head of the Tech Division for Wells Fargo. I said, “Can you mentor me? Can you teach me?” I wasn’t even thinking, “Teach me how this game works. I’m a good student. Teach me.”

As he’s teaching me, he can see my vision and what I wanted to build. Finally, I convinced him, “Let’s set up a venture capital fund together called DragonX Capital. Let’s build something together.” Finally, I have a seat. If someone wants to set up a venture capital fund, there are only a few banks, Silicon Valley Bank or the First Republic, that can do it that specialize in fund formation. They don’t set up any new accounts if you are not an existing client. If you don’t have a fund right now, you can’t even set it up.

You won’t get one.

You can’t even open an account.

All money isn’t green, and it doesn’t make a difference how much money you got.

They do not take on a new client. You can’t even get an account. That’s how closed-door this is. It’s ridiculous. Through Ivan’s relationship, we’re able to create the fund. We set up the fund and then now I’m in the door finally. I look at that, and I’m like, “We can help all these amazing founders.” I work with entrepreneurs all my life, you know that. Look at all these tech founders. I said, “This is an amazing opportunity.”

If I can open this up using DragonX Capital as a gateway to your community and my community, where people who would never have the opportunity to invest in these deals now could, what would happen? Think about it. We know that from the Chinese community and the African-American community. It’s the same thing. There’s a lot of money there too. Now you have more influence in the whole tech space. That’s how I see it. Even for African-American founders, it’s hard for them to get funding. You look at my website, DragonX Capital. Do you know who we back? Minority founders.

Come on, Dan. Let’s go.

Our investors are the minority, “You’ve got a good idea. You’ve got a good tech. You’ve got good software. Let us back you. Let’s do it.” That’s why you can see the website. We invest in big taglines. We invest seed in the early stage outside of Silicon Valley. Even if you are in Australia, we can back you.

The 16-year-old Math genius, tech whiz, and software genius can come to Dragon X capital and get funded.

Yes. Contact us. Pitch us your idea. More than that, because of my education and my background, the difference is this. I’m going to take you behind the scenes of how this industry works.

Thank you. My audience appreciates it. Please do that.

Everything I’m telling is a private club. You can’t get in. It doesn’t matter how much money you have. They won’t let you in. They won’t let me in.

They’re making examples of individuals and celebrities as we go on. It doesn’t make a difference how much money you’ve got.

I had money, and they wouldn’t let me invest. I said, “You wouldn’t take my money?” “No.”

Your money isn’t green over here.

It’s almost like, “We don’t let people you invest,” attitude.

It’s not about revenue. It’s about relationships.

It’s nothing to do with that. It’s all relationship.

It’s more relatable that way.

We are brand new. This is the first year of a brand-new venture capital fund. We have no track record yet. Here’s my prediction now. This is 2022 on Branding You declaration to the world.

Where are we going to go? I predict our venture capital fund would be one of the most successful venture capital funds in the world. Here’s my prediction and why I would back it up. Here’s what most venture capital funds do. You need some money. They write you a check. See you in ten years. I said to myself, “You give the founders the money.” I am a business owner myself. Giving someone money without giving them skills doesn’t help.

Giving someone money without giving them skills doesn’t help.

Money doesn’t solve money problems. Come on.

They still have sales issues. They still have lead generation issues. I happen to know a thing or two about that. I’ve got certain skills. The way that most venture capital firms do when they invest money is more like passive investing, “I want to check. Goodbye. Don’t talk to me in ten years.” I said, “What if I do active investing?” I’m giving you the financial capital, that’s good, but I’m also giving you the intellectual capital. I’m also giving you the training. I’m giving you mentorship. I’m giving you support. I’m giving you my network. Wouldn’t those investments do better? Wouldn’t the success rate be higher?

It’s an incubator.

Wouldn’t the founders feel more supportive? What if I also put them together in an advisory group so they could help each other? What if we do that? It’s a platform. The founders do better. The companies do better. Our return would be greater. Our investors would be happier. I am then in control of the rate of return versus if I buy stock, I cannot call up the CEO of whatever stock that I buy, “I don’t like the way you’re doing things.” “Who are you?” Now I know the company I have invested in. I call the founders. We know what they’re going to do. We know what moves they’re going to make. I have much more certainty. This is why I’m not interested in investing in other things. I don’t know how they will do.

You can’t have influence over the outcome.

I can’t add value.

Here in DragonX, you have a founder mastermind?

That’s right, through TIGER Council.

TIGER Council, where founders find a community of other founders. They’re able to speak, decompress, and divulge all of the stresses.

TIGER is an acronym. It stands for Tech, Innovate, Grow, Exit, and Raise capital. That’s what we teach. What do we teach? We teach founders that. Building the software, building an engineer team, growing, and getting traction, all that is good but that’s not the biggest challenge. The biggest challenge is how they get the money. How do they get the capital to do all that?

You got the edge.

Most founders don’t know how to pitch. I do it because I see founders pitching to me every day. I’m like, “This is a bad pitch.”

I’m thinking of Shark Tank. I’m thinking of all the founders there.

They don’t know how to pitch. Sometimes they pitch but they don’t know how to structure the equity, “How much equity should I give away in exchange for this money?” Sometimes they give too much. Sometimes they give too little. Sometimes the valuation is too high. They don’t know these things. No one is teaching them. I say because, on the other side of the call, we are the venture capitalists.

I know how we think. Let me help you to structure your pitch so you get the money that you need, not just from us but from the next level when you get bigger and bigger. I combine the capital side with the education side so I get better returns. Why would I want to help them? When I help them to get to the next level, I could also invest.

It’s a win-win-win.

It’s an ecosystem.

I’m very educated. I have multiple degrees, multiple backgrounds, and multiple different universities. I had the pleasure and the privilege of sitting down with Jack Welch before he passed away. He talked about General Electric and turning GE into a university. He called it a leader feeder. This is why he was the Chairman of the board for so many years and the CEO of the Century because he got a 400% multiple on what GE was when he entered.

They called him Neutron Jack for a long time because he always cut off the bottom 10% but people who were phenomenal, they’re all CEOs of multiple different companies now, whoever went through the leader feeder. What you’re describing to me is TIGER Council and DragonX Capital are the same thing, a leader feeder and a founder university.

It’s simple. If I’m giving them the capital, I want them to use it wisely. I want them to deploy the capital and hire the right people. Let’s teach them how to do that and get them ready for the next rung of funding so that they could go to the next level. If they could do that, our investments do better. If our investments can provide a return that’s exceptional, investors would be so happy. To me, that is an ecosystem, and that’s disruptive.

It’s very disruptive and innovative.

We are already getting investors from investors who may not have an opportunity to invest in these opportunities and deals. On the other hand, I’m providing support to founders who might not get the support in the traditional sense because maybe they’re outside of Silicon Valley, they’re too young, they’re minorities, or whatever it might be. If I can provide that and they’re smart and good, now they have an opportunity to utilize the capital and build something great. I can do this until I’m 80 years old. It will never be boring for me.

If you’re reading this right now, number one, this is Hollywood ground. You’re lucky. This is a blessed conversation that we’re having with Dan Lok. If you are a founder who’s fledgling but has a phenomenal idea, creation, or innovation, and you don’t have the resources, funds, support, people, counseling, advisors, coaches, consulting, solace, and home that you need, it’s here.

If you have discretionary capital and you don’t know what to do with it, you can’t get in, you’re blocked out, your money isn’t green over there, nobody seems to accept you, you don’t know what to do with the nest egg, and you don’t know what to do with the seed, here is fertile soil. Correct me if I’m wrong, but that’s what I’m hearing. Here is somewhere where you can plant it. It can be nurtured. You can be sound and feel safe in your investment.

I was talking with a potential investor a few days ago. I was asking him. This investor is wealthy. I said, “Let me ask a question. Do you have a stockbroker?” He said, “I do.” “When a stockbroker sells your stock, the stock goes up. Stock goes down. Does he care? Does he make less commission if it goes down?” I said, “Do you have a real estate broker?” He said, “Yes.”

“You buy a piece of property. The agent makes a commission. The property goes up in value or goes down in value. Does the person make less commission?” “No.” Your investment ups and downs don’t affect them. The way that we set up the fund during the next capital, first of all, we turn all the principal first to investors before we do any split. 1) We don’t make money until the investors make money. 2) I am the largest investor in the fund.

That’s leadership.

I will always be the largest investor in the fund. It’s simple. Investors and my interests are aligned. It is in my best interest to maximize the return and help the company succeed. It’s that simple. How do I know it’s going to work? It’s because I put all my money into it. If I don’t make money, I work for free. I don’t work for free. When it’s in my best interest to do so, you can trust it. It’s that simple. I would be watching the money more carefully than you watching your money. Believe me, because my money’s all in there too. You don’t need to call the founder. I will call the founder.

Let me ask you this. When someone does that, when someone invests with you, or when someone comes in, do they have access to you? I’m thinking of the questions that might be asked on the outside. When they do make the investment, you’re going to call the founder, but do they have access to you? What does that look like? Does it look like a community?

We have both. I put both founders and investors together. The investors will be able to see the founders, and what they’re doing. Wouldn’t it be nice? You invest in something. What is going on?

That’s something else there.

It’s transparency. When you buy something like Bitcoin crypto, you don’t know what is going on. You know the recent news. The founder’s like, “Here’s what’s going on.” Investors report every quarter. You know exactly what’s happening. Everything is transparent, and you will know. We have an online area. You can see exactly how much we invest. Here’s what’s going on. Everything is transparent. First of all, with the SEC, everything has to be transparent anyway. You know exactly what is going on, what’s happening, how the company is doing, what’s the valuation, and everything. That’s what I would want if I put my money into it.

This conversation has taken a turn to the good, the better, and the best. This was not premeditated. This was not what my idea was. I’m so glad that we got here because it’s so beneficial to the communities that need it. We have been blackballed. We had restrictions and got prohibited. We’re not granted access to the player’s ball or whatever that looks like. I want to thank you for that for all of the communities.

I hope you’re paying attention, guys. I won’t ever bring anyone in front of you that I can’t say is 100% authentic, genuine, and someone that I subscribe to, invest in, and invest with. I’ve been working with Dan for the last few years, and it has done nothing but add a zero to my net worth, my confidence, my community, my intelligence, and my growth as an individual, as a professional, as an executive, and as a leader.

We are coming to a close on such a phenomenal, insightful, narrative-changing conversation with Sifu Dan Lok because he is my Sifu. Dan, I would love for you to expound because everything is leadership from the beginning to the end of it. You will not go as far as your leadership would take you. Leadership is everything in business. It’s everything in branding. Let me know on your side of the world, at your level, how important leadership is.

First of all, I want to say I wasn’t always a good leader. I was a lousy leader for many years of my life. For the first many years, I was a solopreneur. I got some contractors, some assistance, and stuff, but it was a one-person operation because I was a control freak. I don’t trust people. I was micromanaging and doing all that. Sometimes, we’ve hired people and then you get disappointed. You’re like, “I’m not going to hire again ever. I’m not going to trust all these things.” We grow bigger and bigger. I notice I cannot do everything. I need people. I have made so many mistakes.

I’ll give you some examples, the ones I remember. There’s probably a 200-page book on all the hiring mistakes that I’ve made. I could do that. At one point in my career, I have over 40 people directly reporting to me. Horrible idea. Complete chaos. You should never have more than seven. I have had a two-year legal battle with an ex-employee. I’ve had a business partner who took advantage of me and then went out there, badmouthed, and talked crap about me. An employee who I have paid off their debt talked crap about me.

I’ve had to fire my chief operating officer two different times, two different people. I have had my number one media buyer who, in the middle of an expansion, quit in the middle of that and go work for my competitor. We were running the ads and all that. I could go on probably 30 more case studies and some of these things that have happened. I’ve had one of my executives on a project who spent $500,000 with nothing to show for it. I’ve had my horror stories.

Most people would be like, “I don’t know if I want to be a leader. It sucks. It’s so hard.” At the same time, to scale and grow, we have to lead. The problem with leadership is that you don’t get that from a book. You get some ideas from a book, but you need to develop that. You need to earn the respect. It’s not about the title. It’s not, “I am the CEO. You listen to me.” You know that you got to earn the respect of your team. I’m always a student of leadership. I’m always learning. I don’t consider myself a great leader. I’m always learning how to become a better leader. Your company is limited by your management, your vision, and your leadership skill. That’s how I see it.

your company is limited by your management, your vision, your leadership skill.

In order to develop one’s leadership, what are three core principles? Everyone reading will not follow and become a part of what we’re doing. That’s okay. If you could leave the people with the three core principles of leadership that if they take action will transform their personal, professional, and business lives exponentially, what would those three things be?

Let me give you something useful and not what everybody says. The first thing you do, number one, and I didn’t believe this, is culture eats strategy for breakfast. Your people and what forms a culture are your core values. Most people, if you’re running a small business, you’re like, “Core values seem so fluffy, big company, and all that stuff.” I didn’t use to buy into that either until I run a bigger business.

My core values are on my website. It’s UNLOCK. You can go and see it. It’s an acronym for Unity, Next-Level Performance, Loyalty, Ownership, Customer-Obsession, and then Kaizen. That’s my core values. All the people I hire are based on core values. When someone comes in, I say, “Think about core values as your DNA. Here’s the DNA of the company. Do you fit this criterion?”

“Is it a fit?” There we go.

I fire based on core values. When I fire someone, it’s not like, “I don’t like you.” It’s “Whatever you’re doing or the mistake you make, that’s not next-level performance or that is not unity. You don’t embody the core values. Sorry, not a good fit.” I also coach based on core values.

When someone’s not doing a good job, I don’t say, “John, I don’t like the way you do it.” “John, one of our core values is next-level performance. We’re always striving to learn. We’re always striving to do better. It seems in the last few months, you’ve been taking a back seat and you are not all in. Can you tell me what is going on?”

Taking the time to do that, that’s number one. It’s very tactical. It sounds like, “I don’t have time for that. That’s for a big company.” You will never get big when you don’t have this. These are your guiding principles on how you make decisions and how your team performs when you’re not there. How do you free up your time? By having core values. Here are the four types of employees that you have. At the top, we have performance and then culture.

Someone who is, “I’ll do it quickly,” or someone who’s high performance and high culture, I call that A-players. If we have A-players, what do you do? You get out of the way.

You don’t do anything. You leave them alone.

Don’t micromanage because they are high-performance. They’ve got the skill. They’re high culture. They believe in what you do. They fit the culture. If they’re loyal, leave them alone. Don’t try to micromanage. Let them shine. You then have people who are low-performance but high culture. They’re loyal. They’re good people, but they don’t have the skills. They lack some skills.

What do you do with these people? You give them training. You need to train them to elevate their skills so that they could become A-players. They are high culture, loyal, but low performance. You then have C-players. These are the people who are high-performance but low culture. Sometimes I call them buttholes. This could be your number one sales guy who doesn’t show up on time.

This could be your top person who has been around for a long time. They feel like they’ve got special privileges. They don’t need to do certain things. They feel entitled. They’re very good at what they do but low culture. What do you do with these guys? You got to coach with consequences. You got to have a one-on-one with them and say, “We got to talk,” with consequences. If they don’t change, they’re going to be gone. Sometimes you do need to let them go. I know it feels like, “That person is producing 20% of revenue. That person has been with me since the beginning.” I get it, but here’s the problem. If you keep these guys around too long, what is the A-player thinking?

You don’t have the right culture and you’re not leading. They’re more important than they are so they will change into C-player themselves.

They get away with this stuff. They will turn the A -players into C-players. You’ve got the D players. You got to fire these guys immediately, low culture, and low performance.

Get rid of them.

Why are we even having them? They should be gone.

That’s the bottom 10% that Jack Welch was talking about.

Here’s what happens. When I coach business owners, I said, “The first thing you got to do with the existing team, you got to look at your people. Who are these guys? Who are the B-players? Who are C-players? Who are D-players? Percentage-wise, you got to be honest.” You cannot be, “I think it’s A.” No, Come on. Let’s be honest.

The first thing you do, you go back to your business. You fire these guys first. First of all, put the business in a little bit of chaos. That’s not a bad thing. Brace the impact. It’s knowing that it’s going to be a little bit shaky. Rock the boat a bit. It’s okay. When you do that, here’s what’s going to happen. You do that first. Guess what’s the A-player thinking?

“That’s good.”

Guess what the A-players are doing? They’re cleaning up all the messes. They’re deep thinking. They’re like, “Thank God they’re gone. I don’t have to clean up the mess. Finally, I can do what’s productive.” You then have a conversation with the C-players next. They see you fire all these people. They see you were serious about change. I didn’t know you were that serious.

They start wondering if they’re next.

Now they know you’re not monkeying around. This is serious stuff. You are going to fire them. You have that one-on-one. They pay way more attention. You can turn some of them around and turn them into A-players in a number of months, good. Some of them cannot, so then they need to go as well. A percentage will be here, a percentage will be there.

Now, the B-players are watching, “All these people are gone.” You sit down with them and say, “John, Michelle, and Kathy, I love your loyalty. It’s great. I see that you’ve got great potential, but I need to give you some training to elevate your skills.” Now they’re much more motivated. With one single move, these guys free up their time, pay attention, and want to get trained. That would be the second technical thing that you can do.

Last one, John Maxwell said it best. He said, “If you think you’re leading, you turn around and no one is following, you’re not leading. You’re taking a walk. Good leaders have good followers.” Shaan, you teach this. How do someone who’s a good leader? Look at how many followers that person has. No one gets followers without being a good leader. If that person is influential, a lot of people pay attention to what that person says. They have a lot of followers. That’s a good leader. All good leaders are good followers.

No one gets followers without being a good leader, and all good leaders are good followers.

In my CEO position, I’m leading, but then I’m also following my mentor’s footsteps. I’m following people who are better. I’m following people who have more experience than me. We learn to be better leaders by being good followers. Most people don’t know how to be good leaders because they’re not good followers themselves.

I would call myself a good mentor because I’m a good mentee. I know what a good mentee looks like. I behave like a good mentee. The relationship with my mentor is so much better. This is why Alan’s been my mentor for 20 years and Dan’s been my mentor for 15 or 16 years. We have a long-term relationship because I know what a bad mentee looks like. I don’t want to be that. I know what a good mentee looks like. I want to be that. That makes me a better mentor and a better leader as well.

This will be the last question, Dan. Thank you so much for your time. You’ve spent a lot of time and you were teaching before this. There are 10 million to 100 million subscribers already. Subscribe to Dan’s stuff and get in there. Get some more wisdom, knowledge, and understanding of leadership, culture fit, and hopefully, investing. Move over to that side, all of the different influential spaces, the copywriting, and the closing. This is the last one, Dan. How important is mentorship?

I would not be where I am without my mentors. There are three ways to learn in life. The first way is learning from yourself. The advantage of learning from yourself is there’s no tuition. Anyone can start any time, no bear of entry. You can make a mistake and learn from yourself.

There’s no tuition, but it’s their cost.

Pain, time, and money.

Learning from yourself is not really free. It’s free to learn, but it’s not actually free. Here’s the problem with learning from yourself. As human beings, we creatures of habits. I give you an example. Shaan, have you ever made a mistake more than once?

Over and over again? Yes, I’m famous for that.

Until we learn it, sometimes we made a mistake many times. We don’t know. There are two problems with learning from yourself. Number one, either you don’t learn because we repeat a mistake or you learn the wrong thing. I’ll share a quick story. Remember I was sharing with you that I was getting bullied in high school and getting beat up? One night, I was watching a Bruce Lee movie, Return of the Dragon. He was in Rome, fighting with Chuck Norris, and beating all the bad guys. I was getting bullied in school. I was watching cable TV. Bruce Lee came up on the screen. I’m like, “This is my hero.” Instantly, I fell in love with Bruce because of the same thing.

He couldn’t speak a word of English. I couldn’t speak a word of English, but he’s kicking all these bad guys and doing all that stuff. I’m like, “This is amazing.” I fell in love with martial art. I would watch all the Bruce Lee movies, The Big Boss, Game of Death, and Enter the Dragon. I would get a little pillow at home. I would hit the little heavy back in a pillow, practicing what he does and all that.

I would get a nunchuck, and I was doing a nunchuck at home and all that. I also was taking martial arts classes. I fell in love with martial arts. Anyway, long story short, many years later, I’ve had the privilege to learn from my Sifu, Ted Wong, who is Bruce Lee’s original student. He spent more time with Bruce Lee than anybody else. A lot of photos that you see in magazines and stuff is Ted and Bruce. Ted was training in his backyard all the time. He was the one that’s getting kicked all the time. He had held it back and was holding all that stuff.

I’ve had the privilege of studying with him. I know what he likes, so I was the one that’s spending more time with him than anybody else. I’ll take him to his favorite restaurant because I know what food he likes. He likes barbecue pork, in case you’re wondering. The first time I saw him, he said, “Dan, show me your understanding of Bruce Lee’s martial art.” I was like, “Here we go.”

I was doing the kicks in. I got my nunchuck and did all that stuff. Sifu was like, “What is this?” I said, “Sifu, Bruce Lee’s martial art. That’s exactly it.” He said, “No. That’s what it’s in a movie. That’s not Bruce Lee’s martial art. His martial art is the exact opposite of that. It’s economy of motion. It’s not telegraphic motion. No screaming. No jumping around. None of that stuff. It’s not what it is.”

Here is the problem. I was learning from myself. I learned the wrong thing that I thought was right. The second way is you can learn from your peers. What’s the problem with learning from your peers? Let me ask you a question. Your peers, the people that you know, do they earn far more than you, far less than you, or the same?

Either far less or the same. Hopefully, the same but that’s not the person you need to be learning from.

That’s right. Think about peers. Let’s say you want to learn how to dance. I say, “I want to learn how to dance.” He’s what I won’t do to learn. “Shaan, I don’t know how to dance. Do you know how to dance? You don’t know how to dance. Let’s get together. You don’t how to dance, perfect. Join us. You qualify.” We get a bunch of people together who don’t know how to dance. We get in a room. We still don’t know how to dance.

A pool of ignorance is not wisdom. You get a bunch of people. Think about if they earn the same as you, a little bit more than you earn, or far less than you. That means their business acumen and financial savvy are roughly the same as yours. If you don’t know how to do something and they don’t know how to do something, and somehow you guys get together, you won’t know how to do it.

That’s where a lot of these communities come from. It’s the communities of people that don’t know what they’re doing.

It’s the blind leading the blind, but it feels good. It feels like you have some emotional support. It feels like networking. It lets you talk about it. You don’t know what you’re doing. They don’t know what you’re doing. You’re giving each other the wrong information. Does this work? Not really. The last way is learning from a mentor. Who’s a mentor? A mentor is someone who’s been there and done that and continues to do it. Here’s the difference when you’re learning from a mentor. A mentor has made the mistakes that you’re probably about to make. They have arrows on their back. They have gone through hardships, adversity, and all that. How do you know you’ve got a good mentor? It’s simple. Let’s say you say, “I want to climb Mt. Everest.” Let me ask you a question. Is it a big goal?

It’s huge.

Is it dangerous?

Very.

Here’s a question. Let’s pretend that’s your pinnacle successful business. That’s your goal. You’re going to climb Mt. Everest. Would you say, “I’m going to go grab some gear and go by myself?” Would you do that if you want to climb Mt. Everest?

No.

Why not?

I’ll probably be on one of those small precipices, dead.

Here’s the thing. Would you go get a bunch of friends, and say, “You’ve never done it. I’ve never done it. How about we grab some gears and go?”

They probably got a lot of helicopters for those people that choose to do it that way.

What would you do? If you ever watched someone who ever climbed Mt. Everest, you see these photos online. They would take selfie photos. You got to take the photos. You’re on the top of Mt. Everest. It’s one of the greatest moments of your life, the greatest achievement in your life. You see this picture. You got frozen goggles. You have a runny nose and all that. Maybe some guys take your photo and you would see the reflection of the goggle. It’s a little skinny guy, 150 pounds, carrying 100 pounds of gear, taking the photo.

Sherpa.

It’s the greatest moment of your entire life, “Finally, I’m at the top of the world. I finally accomplished my goal and built the business that I want, or whatever it might be. This is amazing.” To your mentor, it’s just another Tuesday. “You know what? I was here last week.”

They going to do it next week.

That’s who you want. It’s your greatest accomplishment. You finally get there. To him, it’s just, “I take people here all the time. You’re the 200th people that I’ve taken on to the top of the mountain.” You don’t want a guide that’s like, “This is my first time doing it. Let’s see if we can make it.” You want a guide that’s like, “Again. What’s new?” That’s a guy that can get you up there and get back down safely. That’s life. To answer your question along with that answer, that’s how important a mentor is.

Thank you so much for your time, Sifu. I greatly appreciate it. Guys, you read it here, all of it, the origin story, the middle story, the growing through, the bullying, the business development, all of the competencies, different stories, the confidence built, the wife, the life, the culture, the business, the losses, the pain, the agony, the flames, and the fire. Now, the investing to the mentoring to the Sherpa.

Dan Lok, thank you so much for being here on the show. I greatly appreciate it. The readers are going to learn more than they probably can digest in one sitting. My advice to you if you’re reading this is to read it over and over. Every time I read the same thing that I’ve read over and over again from Dan Lok, I always learn something new.

Thank you, Shaan. Thank you for being the leader that you are and impacting so many people’s lives. I want your audience to recognize that it’s not easy to find a good mentor that actually cares. Shaan is someone that cares about your success. That’s why he does what he does and how hard he works, who he represents, and what he represents.

As I said, Shaan’s been with me for years. He knows me. I know him. This is not one of those interviews where, “We don’t know each other. Let’s jump on a show and pretend to know each other.” We know each other. We’ve been working together for years. Here’s someone that truly cares about your success and knows what he’s talking about. You’re lucky to have him. He’s lucky also to have you. That’s what a good mentor-mentee relationship is like. I hope you take this interview as inspiration or even as a little kick in the butt that, “I could do more. I could be more.” If you could do that, I’m happy.

Thank you so much, Dan. Again, this is the phenomenal Dan Lok in this session of Branding You, not what you do. Let’s grow.

Important Links

About Dan Lok

Dan Lok is a Chinese-Canadian business magnate and global educator best known for being the founder and chairman of Closers.com – the world’s #1 virtual closer network, which connects companies to closers.

Beyond Closers.com, Mr. Lok has led several global movements to redefine modern education where Mr. Lok has taught men and women from 120+ countries to develop high-income skills, unlock true financial confidence and master their financial destinies. Beyond his success in business, Mr. Lok was also a two times TEDx opening speaker. An international best-selling author of over a dozen books. A member of the Young Presidents Organization (YPO) – a private group of global chief executives whose companies employ 16 million people and generate 6-trillion USD in annual revenues. And he is also the host of The Dan Lok Show – a series featuring billionaire tycoons and millionaire entrepreneurs.

Today, Mr. Lok continues to be featured in thousands of media channels and publications every year and is widely seen as one of the top business leaders by millions around the world.